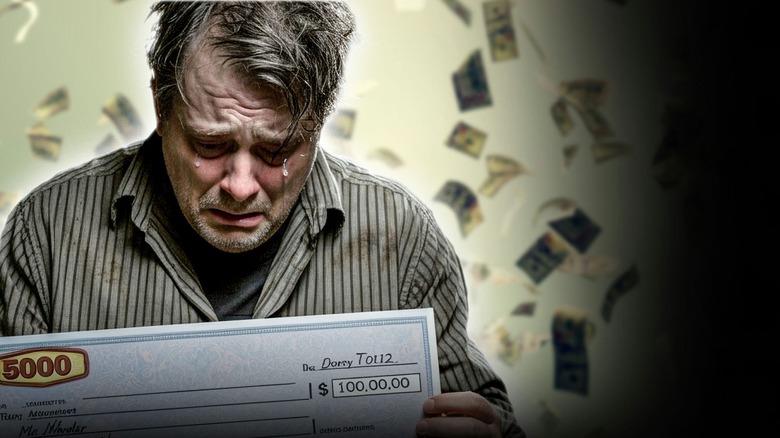

Why It Sucks To Win The Lottery

On the surface, playing the lottery is an exciting idea. For the price of an ice cream cone, you can enter a lucky draw that will ensure financial security for the rest of your life if you win. But the reality of actually winning millions of dollars in the lottery is often not as blissful as it sounds. Lots of money equals lots of interest from other people, and some of them might not have the most honorable intentions. Everyone wants a piece of the pie, and who can blame them? Money is that special thing that no one talks about but everybody thinks about.

When an average citizen suddenly becomes a millionaire, there's an uncomfortable level of risk associated with that newfound wealth. When you consider the nuts and bolts of hitting the jackpot, realizing you're holding that coveted winning ticket isn't the wish-fulfilling scenario it seems to be.

Money is stressful in relationships

Maintaining a healthy relationship is hard enough, but sorting out finances between two people can be a real headache. Someone will inevitably earn more money than the other or have more savings or inheritance, which creates an inherent power imbalance. And that can cause the person with less money to feel undervalued. Now imagine one of those two people has won millions of dollars in the lottery. If they're not married, couples who share finances might have some ugly legal issues to wade through.

If they are married, the funds are typically shared. Sounds great, right? Not so much. The New York Times calls it a lottery "curse" and reports it has affected numerous couples. For example, one month into their marriage (what are the chances?), David and Victoria Jones won $3 million in the lottery. That lead to maniacal overspending, an extramarital affair, and the conclusion that the attention after their lottery win "ruined their life." In 2009, Les and Samantha Scadding won $59 million and divorced shortly after. In 2012, Adrian and Gillian Bayford (pictured) won the equivalent of $193 million and separated a year later. Whether dating or married, winning the lottery puts a lot of sudden stress on a couple to figure out a financial plan — and agree on it. Easier said than done.

Finances are easily mismanaged

Although it can be a hassle, budgeting is one of those things humans just have to do. Sometimes, money needs to be set aside for emergencies, or rationed, or invested, or saved — you know, normal everyday stuff that's all part of financial literacy. For a lottery winner, the need to have a budget and long-term goal increases exponentially. But the reality is that many lottery winners have gone bankrupt because they didn't work out a budget with a trustworthy financial adviser. If there's no one there to encourage self-discipline, the likelihood of mismanagement (money being lost, stolen, or frivolously spent) is dangerously high. There are many articles that suggest the top things that lottery winners should and should not do; informing a financial adviser always comes before spreading the news to family members. It's also important to involve an estate planner to figure out who is entitled to the money when the winner passes away, because that can be a whole new disaster. The "fun" never ends.

Money equals greed

Even if a lottery winner didn't display egregious amounts of greed before, it's totally normal to desire more things after the big paycheck. The NY Daily News states that "nearly 70% of lottery winners go broke within seven years" and cites greed as the culprit. David Edwards won a $27 million jackpot in 2006 and went on a shopping spree that included a $200,000 Lamborghini Diablo, a limo business, three racehorses, a house in Palm Beach, and more. Tragically, he ended up in a worse position than he was in before the win — living in a grimy storage unit and using cocaine, heroin, and prescription drugs.

In 2006, Sandra Hayes split a $224 Powerball Jackpot win with several colleagues, ending up with $6 million for herself. "I had to endure the greed and the need that people have, trying to get you to release your money to them," she told the Associated Press. "That caused a lot of emotional pain. These are people who you've loved deep down, and they're turning into vampires trying to suck the life out of me." Greed brings out the worst in people.

Money is an enabler for bad things

It's one of the secrets the lottery doesn't want you to know: Winning the jackpot can lead to ruin. The more money someone has, the more risk of getting into serious trouble. Take Michael Carroll, for example. He won $15 million in 2002, and spent everything on parties, cocaine, quad bikes, cars, and sex workers. He was later convicted of drug possession and went to jail. That same year, Jack Whittaker won $315 million and hit up strip clubs with insane amounts of cash. One day, a robber stole $545,000 from him while he was sitting in the parking lot. (The money was in a suitcase ... not the smartest idea.) A few years later, his granddaughter died of a drug overdose. He attributed her drug use to his winnings, which is devastating. In 2015, a lottery winner named Ronnie Music Jr. invested some of his $3 million lottery winnings in a crystal meth drug ring. Two years later, he was sentenced to 21 years in prison. Could all of that have been avoided? Maybe. But temptation is no joke.

Money can be dangerous

People who want something badly enough will stop at nothing to get it. Lottery winners have to exercise extreme caution when going about their daily lives because news of big earnings spreads fast. The list of lottery winners who have been attacked or murdered shortly after receiving their checks is a long one.

In 2016, a group of people in Georgia were charged with the murder of lottery winner Craigory Burch Jr. Two months after he won over $400,000, seven people allegedly broke into his house and shot him dead. His kids and girlfriend were home at the time. In 2012, Urooj Khan mysteriously died of cyanide poisoning the day after his lottery check was issued. Abraham Shakespeare won $31 million in the early 2000s and disappeared a few years later. A woman who "befriended" him was eventually convicted of his murder. William Post won $16.2 million in 1988, and his brother allegedly tried to hire a hit man to murder him. (The attempt failed, but Post's life continued to be marked with tragedy.) In all these cases, money caused people to behave irrationally.

Clearly, lottery winners themselves — not just their money – have to be protected at all times. And it all comes back to telling only the people who need to know. That can be difficult when many states allow the public release of lottery winners' names. Feels a little like the system is working against winners, huh?

It's not as much money as you think

Most people dread tax season because it can be a hassle to get everything in order. But imagine owing taxes on a Powerball jackpot. Lottery winnings are viewed as taxable income, and navigating that minefield is another reason why it's crucial for lottery winners to have top-notch financial advisers.

There are essentially eight U.S. states that don't tax lottery winnings at all. In December 2024, CNBC noted that if a person lived in one of those states and was the sole winner of a $1.15 billion Mega Millions jackpot, they'd end up taking home $325.1 million after federal taxes if they chose to receive the lump-sum payout. If they opted for the 30-year annuity, their take-home winnings would eventually amount to around $725.7 million. In other words, winning $1 billion wouldn't make you a billionaire.

The issue of taxes gets more complicated when lottery winners share their money because federal gift taxes and inheritance taxes come into play. All these things depend on state laws, and those change all the time. Bottom line: Lottery winners need a support network to deal with this stuff.

Can't trust anyone anymore

Trusting people is a gamble even if you have nothing. But lottery winners have it way worse. When everyone wants a piece of you, how do you determine who has your best interests at heart? It's similar to being famous. "Do they really like me, or are they just trying to get something from me?"

When huge amounts of money are involved, people usually want something. Lottery winners risk death and danger when they tell people about their payday. It's that simple. Illinois attorney Andrew Stoltmann told the Associated Press that forcing lottery winners to reveal their identity is like "throwing meat into a shark-infested ocean." They're a target for unsavory characters to appear out of nowhere, begging for coin.

So what's the solution? The best thing winners can do to maintain a normal lifestyle is remain anonymous. You might achieve that by moving to a remote island, surrendering every shred of identity, getting a normal job scooping ice cream, never using social media again, and not spending unusual amounts of money. If that life is too hard to comprehend, establishing a blind trust (aka, getting that trustworthy financial adviser) is the only way to go. You think you have trust issues? You sure might, but they're probably mild compared to the victims of Powerball.

Millions of dollars is not motivation to work hard

Many lottery winners quit their day jobs because they think, "I'm rich! Why work ever again?" That's understandable. Having plenty of money in the bank can set you up for early retirement and allow you to spend more time doing fun things. That might be a great life for a while ... until boredom inevitably sets in. The decision to quit a job is also a decision to stop working hard to achieve professional goals. No more bonuses for good work. No more hard-earned vacation time. No colleagues to celebrate triumphs with. No support network. No motivation.

A 1978 study from Northwestern University and the University of Massachusetts examined lottery winners and their happiness levels and found that the "thrill" of winning the lottery wears off. They get used to the added pleasures in their life made possible by wealth, and those pleasures contribute to their happiness less and less. Without making a positive contribution to society, lottery winners can become lost souls.

People look down on lottery winners

Even though lottery winners are perfectly entitled to their winnings, the fact that they didn't really do anything to earn the money grates on the unlucky. It's a case of happenstance instead of working hard for a reward, and some people have a hard time respecting luck. Look at Steve Granger, who won $900,000 in 2005. USA Today reports (via The Atlantic) that at a party with his wife, he heard someone use an "ugly tone" when they said, "There go those lottery people." Ugh, imagine how bad you'd feel.

Then there's the issue of lottery winners themselves feeling awkward or guilty about their sudden wealth. According to some psychologists, the phenomenon of feeling anxious and undeserving is called "sudden wealth syndrome." Money might solve some practical problems, but it doesn't do much to maintain emotional health and well-being. Feeling unworthy leads to unproductiveness, which leads to self-medicating, which perpetuates the cycle of destruction.

Money can't buy happiness

Money can buy a lot of fancy things. It can positively affect happiness levels for a time, but it can't be relied on for a permanent state of bliss. As for lottery winners, they're at risk of becoming more miserable than they were before they won. Donna Mikkin won $34.5 million in 2007 and described her conflicted feelings in a blog post. "One of my very first fears was that we would be judged. I would often tell myself people wouldn't know me or my family for who we really are. The judging would be automatic after anyone heard what had happened to us. There's another key word: 'happened.' I didn't plan this. If you asked me, my life was hijacked by the lottery." "Hijacked" is a strong word, but it seems suitable for this situation. Winning the lottery is a lifestyle change.

Don McNay was a financial adviser to lottery winners, and he shared his matter-of-fact perspective with Time. "People [die by] suicide. People run through their money. Easy comes, easy goes. They go through divorce or people die. It's just upheaval that they're not ready for." Right, because no one prepares to be a millionaire from winning a lucky draw. If it happens, they muddle through it as best they can.

There are hidden fees and taxes

The stated, published dollar amount awarded via a lottery jackpot is a bit misleading. While most any lottery win will provide more than enough money to set up the lucky player for multiple lifetimes, they don't receive the full amount they think they won. As the federal and state governments consider a lottery payout to be income, it's taxed as such. The winner's individual state may claim a portion, and the federal government claims a sum in the neighborhood of 24%. The IRS isn't finished at that point. The victory sends the winner into a higher income tax bracket, entitling the federal government to an additional percentage of the winnings. That means the federal tax rate on a lottery win could climb as high as 37%.

If a winner opts to receive their prize in the form of an annuity, or smaller payments doled out over the span of 30 years, they're similarly heavily taxed. This is to say nothing of the taxes owed on some large purchases made possible by jackpots. Many lottery winners might buy real estate or land, which are subject to annual property taxes.

You might get caught in the middle

Along with other psychological ramifications that come with sudden, unbelievable wealth, lottery winners may suffer symptoms of identity crisis and social ostracization. Jackpot strikers are instantly propelled into the world of the wealthy, which are small and elite circles populated by both people from rich families and self-made industrialists and entrepreneurs. Lottery winners aren't instantly welcomed into the fold just because they happen to have money — they're often scrutinized and even shunned because other wealthy people don't feel like they made their money in a dignified, proper manner.

On the other end of the financial spectrum, those with a less robust income may find it hard to relate to lottery winners. They may even resent or feel jealousy toward their relatives or friends who, up until recently, similarly earned medium to low wages. Lottery winners may have all the money they ever need, but they're socially stuck between two economic groups.

A loss of privacy

One of the side effects of striking it rich on a lottery jackpot: Winners instantly attain a certain level of celebrity, or at least a lack of anonymity. Life changes instantly after those numbers on the ticket match up with the ones drawn by the lottery commission, and winners are no longer private citizens and faces in the crowd but famously wealthy. Not only do they lose privacy, but they lose it at the exact time and for the precise reason that one might want privacy.

Jackpot winners instantly become targets for crime, both petty and financial, and singled out by anyone else who may want a piece of the prize. Because weird lottery rules require the public disclosure of the winners, anyone can find the winner's name and approximate location with only the smallest bit of research. The specifics of how the law is enforced may vary from state to state. Colorado winners' first names and last initials are revealed online; in states such as Wisconsin, New York, and South Dakota, names and cities of residence are disclosed. Arizona keeps identities secret for 90 days after the awards are claimed. In Kentucky, winners can stay private, but their names will be revealed if anyone were to seek it out via a government records query. Lottery winners in other states, including North Dakota, New Jersey, Maryland, Wyoming, and Kansas, can retain their privacy.

If you or anyone you know needs help with addiction issues or is struggling or in crisis, contact the relevant resources below:

- The Substance Abuse and Mental Health Services Administration website or contact SAMHSA's National Helpline at 1-800-662-HELP (4357).

-

Call or text 988 or chat 988lifeline.org