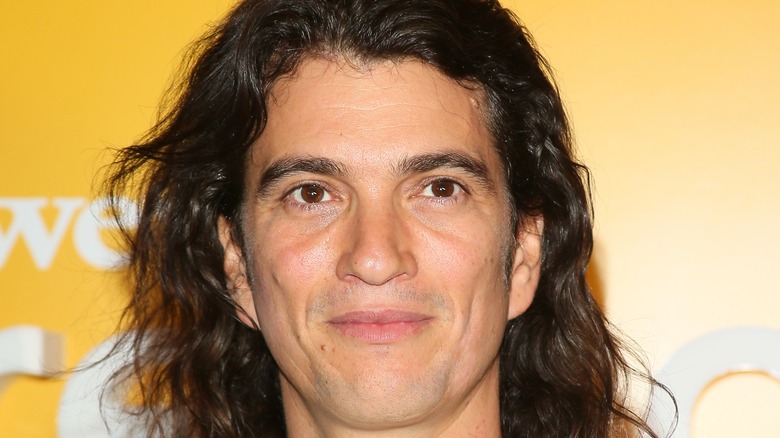

What Is Adam Neumann From WeWork Doing Now?

Adam Neumann co-founded WeWork in 2010, and within years, it was seen as the future of trendy workspaces (via Business Insider). But by 2019, the company was floundering, leading to a devastating fall from grace. Neumann grew WeWork from a small operation in New York, and the company grew exponentially over the next decade, spanning more than 110 cities in 29 countries (via Vanity Fair). He co-founded the business in 2010 and persuaded investors to drop $10 billion into building up the WeWork model, reports The Motley Fool. WeWork, according to the company website, is a real estate company that provides spaces for businesses, often startups, to conduct their work, ranging from office and event spaces to simple desk spaces or open workspaces.

According to HuffPost, the culture at WeWork was focused on combining work and life to an unsustainable degree. Neumann constantly pushed his employees to work long hours for low pay and bragged that they sometimes worked until 3 a.m. He would take employees on mandatory three-day summer camp trips, where employees wore tracking bracelets, drank lots of alcohol, and did outdoor activities that were fun for some, but not all, who were forced to attend. They were told the motto was to put "We before Me."

Running out of cash and options

At first, WeWork seemed too big to fail. Investors gave about $12 billion to WeWork in the decade after its launch (via Vanity Fair). But in 2018, WeWork lost a staggering $2 billion. Questions were bubbling up — how could a business model that combined long-term leases with short-term subletting work out in the long run? In 2019, Neumann had a stronghold over WeWork, with control over 65% of the company's stock, and complete control over the board of directors.

But Vanity Fair reports that at the same time, employees and investors were unhappy with the We Company. Several higher-ups, like the chief communications officer, left the company. WeWork was nearly out of cash; they were reportedly due to run out of money by November 2019 if they couldn't secure emergency funds. Then, WeWork's IPO was delayed when investors rejected it unanimously — even after the company massively reduced the valuation from $47 billion to about $10 to $12 billion. This IPO failure resulted in about 3,000 employees losing their jobs (via Refinery 29).

Luxury spending

While this was happening, around September 2019, the Wall Street Journal wrote a tell-all article about Neumann's work behavior and personal life, which often seemed to intertwine (per Vanity Fair). According to The Motley Fool, Neumann once smoked pot so heavily on a chartered flight that the flight crew had to wear oxygen masks. It was also reported that he had given tequila to an interviewee.

Vanity Fair reports that Neumann had a taste for luxury that clashed with the company's quickly-draining cash reserves. Neumann and his wife spent $90 million buying six homes, and they employed several nannies, chefs, and personal assistants. He flew on a private $60 million plane, and his WeWork office featured luxuries like a cold-water plunge, infrared sauna, and a Peloton bike. Neumann even had a personal credit line of $500 million through the JPMorgan Bank. As one of WeWork's former executives said, "Adam went through money like water."

WeWork leaders were ready to oust Neumann by the end of 2019, and he received a huge exit package, per The Motley Fool. He was provided a combined total of $778 million in stocks and consulting fees upon his WeWork exit.

Life after WeWork

Adam Neumann and his WeWork tale have now been featured on television shows and podcasts since 2020 to the present, including "WeWork: or The Making and Breaking of a $47 Billion Unicorn," on Hulu, "WeCrashed" on Apple TV+, and "WeCrashed: The Rise and Fall of WeWorks," a podcast by Wondery (via Hulu and Town & Country). However, as the New York Post reports, Neumann apparently doesn't read or watch any media that has been created about his dramatic WeWork downturn.

So what's next for Neumann? He has a few tricks up his sleeve, starting with new opportunities as a landlord (via The Motley Fool). Neumann had pitched a project like this before, calling it WeLive, which was described as a group of pre-furnished apartments available to renters, similar to WeWork's furnished office space model.

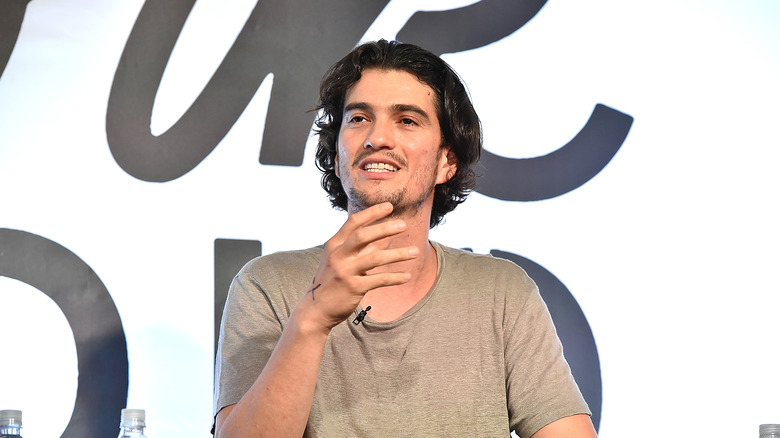

Neumann told the Financial Times that now he has embarked on a project that is "something much bigger than I even knew was possible." In an article published in March 2022, Neumann spoke with a sole reporter, Andrew Edgecliffe-Johnson, about his brand new real estate plans.

New ambitions

Financial Times reports that Neumann has plans for his new real estate to embrace community and welcome young people into the market. Similar to WeLive, a venture that emphasized dormitory-style apartments with cozy common areas, Neumann was not quite ready to divulge details about this new undertaking.

As The Motley Fool reports, Adam Neumann's real estate investments could really benefit him — they're worth an estimated $1 billion. Neumann will be in charge of numerous properties in popular cities and suburban areas, like Atlanta, Nashville, and Miami. The estimated number of apartments he will be overseeing tops 4,000, and he reportedly used his own funds to buy the buildings.

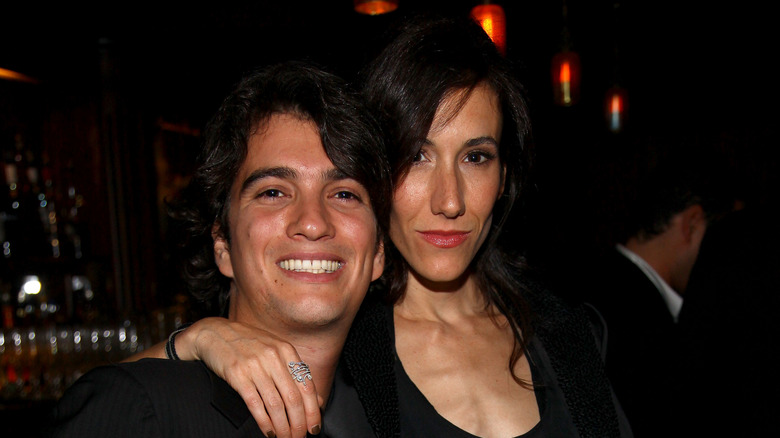

For now, the New York Post reports that Neumann has been living in New York with his wife, Rebekah Paltrow Neumann, and their five children since 2021. They reportedly stay in their properties in Greenwich Village and the Hamptons.

"Big plans" for the future

Interestingly, Neumann also mentioned to Financial Times that he had purchased large amounts of forests in order to address climate concerns. He and his wife Rebekah started Flow Carbon, which helps companies offset their carbon emissions using blockchain credits. Neumann told the Financial Times the company made $10 million in 2021.

Alongside his real estate investments, Neumann invested in a retail concierge business, a mortgage company with tech-enabled services, and companies based in Israel, the New York Post reports. And, he still has a 10% stake in WeWork, reports Financial Times, even after being ousted from the company. Previously valued at $1 billion, the stake is worth about $500 million today. Neumann believes that in a post-Covid hybrid office space, "the opportunity is going to be even greater."

One unnamed source reports that Neumann has yet to reveal his next steps: they told the New York Post, "It involves what happened in the world because of the pandemic. He's got big plans and he's waiting for the right time to announce them."