The Stunning Story Of The $65 Billion Ponzi Scheme

In 1992, the United States Securities and Exchange commission (SEC) launched an investigation into what was the largest ongoing Ponzi scheme in US history (via SEC). After being investigated at least 8 times over a decade and a half time period, New York money manager and financier Bernie Madoff was arrested in 2008 for defrauding investors and clients out of $65 billion in an illegal investment venture.

Unlike the more commonly known "pyramid scheme," where money is made by continually recruiting new investors, who themselves have to recruit new investors in order for them to capitalize on the plan, Ponzi schemes work a bit differently (via Gibbs Law Group). In a "Ponzi scheme", named after the scam artist Charles Ponzi, investors simply turn their money over to a money manager and once done they no longer actively participate in the plan. In contrast, pyramid schemes require continual investor involvement.

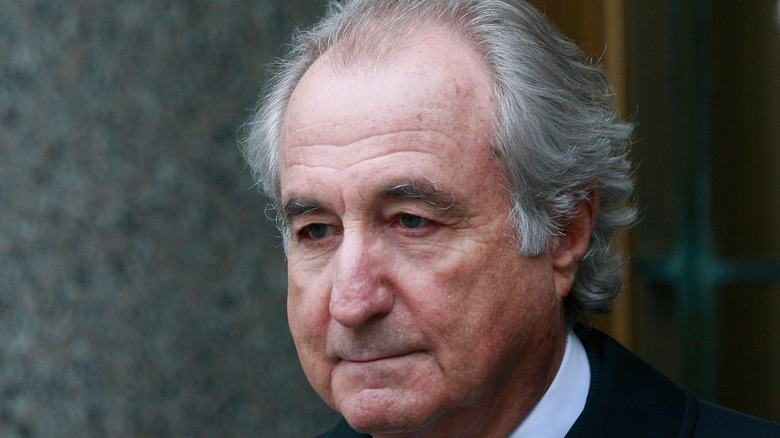

largest ponzi scheme in history

One of the pioneers of high-speed, high-volume electronic trading (via Time), Bernie Madoff's scheme was a fairly simple one. Claiming he was using the legitimate practice of what's known in the financial industry as a "split-strike conversion strategy," to attract investors (via The Journal of Derivatives), Madoff was actually doing no such thing. In fact, the financier's scheme was straightforward stealing. Madoff would convince a prospective client to invest his company, Madoff Securities, that used a special brand of the "split-strike" strategy, guaranteeing returns of 10% (via The Philadelphia Inquirer). The money manager would then take the new client's investment and place it in an account holding other investors' money. Whenever a client was ready to cash out, Madoff simply paid them off out of the money he obtained from other investors. To replace those funds, the financier would simply recruit new investors, adding their money to the pot.

According to The Philadelphia Inquirer, Madoff's crimes reach as far back as 1964, when Madoff insisted that Irwin Lipkin, controller for Madoff Securities, "made false and misleading entries" in the companies' general ledger. Over the next 45 years, Madoff continued to lie, swindle and cheat money from clients. Being the former chairman of the NASDAQ index from 1990-1993 (via Britannica) and an all-around financial insider helped Madoff keep the lid on his money-making scheme.

a scam artist arrested

That is until 2008. Madoff's investment firm was unable to ride out the financial crisis stemming from the economic collapse of '08. Clients came to Madoff's door looking to withdraw their money, only to find there was no money left (via The Guardian). As the economy continued to crumble, Bernie Madoff finally confronted his sons and fellow investment financiers, Mark and Andrew (who according to Town and Country were not involved in any of the Madoff's illegal activities at the time) telling them that not only had the firm lost billions of dollars, but it was also a scam.

According to The Guardian, the Madoff brothers contacted the SEC on December 11, 2008. Later that day, Bernie Madoff was arrested on one count of securities fraud (via CNN Money) for allegedly running the multi-billion-dollar Ponzi scheme. He was later released on $10 million bail. In June of 2009, the money manager was sentenced to 150 years in jail (via The New York Times). Just two years after alerting authorities to his father's misgivings, Mark Madoff committed suicide on December 10, 2010. Bernie Madoff, meanwhile, died on April 14, 2021, from chronic kidney disease, serving only 12 of his 150 sentenced years (via AP News).