What Really Happened During The 1929 Stock Market Crash

They say that life moves in cycles. But if that's so, people can all hope that they never have to live through events similar to those experienced during the Great Crash again. It's not just the insane amount of money that was lost in such a short amount of time, or the long, miserable era the crash brought on, called the Great Depression. One of the worst parts about the market failing so profoundly was that society went from many years of general optimism and prosperity to utter disaster in the blink of an eye.

Even though the economy of the United States was in bad shape months before the crash, people still believed in the stock market. So, they continued to invest as a way to succeed more than ever thought possible before. Some people were literally convinced that the market would never fail. On Black Thursday, the collective optimism suddenly shifted to widespread panic, and this did not stop for nearly a week.

Once the panic had started, it grew like a raging forest fire, until all that was left were the ashes. Panicking is never a solution, and in this event, it became a key component of the massive devastation. Just as Vince Vaughn frantically screamed, "He said not to panic!" while he was surrounded by flesh-eating sharks in Couples Retreat, that was particularly superb advice in this instance as well ... if only everyone could have followed it in late October of 1929.

The economy was already in a recession

Prior to the Great Crash, America was in an age known as the Roaring Twenties, with unprecedented gains in the stock market. According to Time, the Dow Jones Industrial Average quadrupled from 1924 to 1929. There was such confidence in the market that one famed economist, Irving Fisher, even went so far to say that "stock prices have reached what looks like a permanent plateau." It was a dream that was about to come to a brutal end and turn into an unthinkable nightmare.

The shift began in the late summer of 1929, when steel production fell, unemployment was rising, car sales and retail dropped dramatically, far less houses were being built, and farms failed in record numbers. By September, the first major warning of a crash was plain to see because the stock market was doing fine during those many downward trends. Well, not just ok, the market was actually doing great, reaching its peak early in the month on the September 3. By this point, the market had completely disconnected from the actual economy.

Further warning signs amidst general optimism

Throughout the latter half of the 1920s, more people had invested in the stock market than ever before. Even though the economy had begun to enter a recession by 1929, many people continued to borrow money and then invest it in the stock market. Since all people were allowed to buy on the margin, anybody could take out loans and invest in the market. So at the time, two out of five dollars from everyone's bank loans were used to buy stocks, says Time. Most people were winning, so even cooks, factory workers, and shoe shiners were in on the fun.

Yet, according to James K. Galbraith in his book, The Great Crash, 1929, two events were later seen as the pricks that burst the bubble. The first was the collapse of Clarence Hatry's English enterprises on September 20. The financial and industrial empire that the Englishman had created was built on a foundation of sand and was felt all the way to New York. When this was discovered, overall confidence began to fade because people began to suspect that other major companies could also have such faulty financial credentials.

Then, on October 11, the Massachusetts Department of Public Utilities did not let Boston Edison split its stock four to one. This was extraordinary, since no rejection like that had every happened before. Even worse, the department basically said that the company's stock was probably worth much less than what speculators were selling it for. People were starting to realize that the party would soon be over.

Panic escalates before Black Thursday

On Wednesday, October 23, crystal clear signs of the coming disaster were beginning to show. Although the day started fine, a stock-selling spree gained momentum as prices dropped dramatically at the same time. This culminated with 2.6 million shares traded in just the final hour of the day, says James K. Galbraith.

To make matters worse, a severe ice storm struck the Midwest, making it impossible for many people to get the correct information they needed in time. Regardless, there was still a common feeling among many that important people would band together to do the right thing and fix the market.

On the morning of the next day, now infamously known as Black Thursday, nothing was out of the ordinary at first. But then trades started to pick up in number significantly. It did not take long before the ticker keeping track of these trades began to quickly fall behind. Unfortunately, as the trades increased, the price of stocks also began to steadily drop as well. By 11 a.m., the panic had truly begun to set in as everyone was in a frenzy to sell their shares.

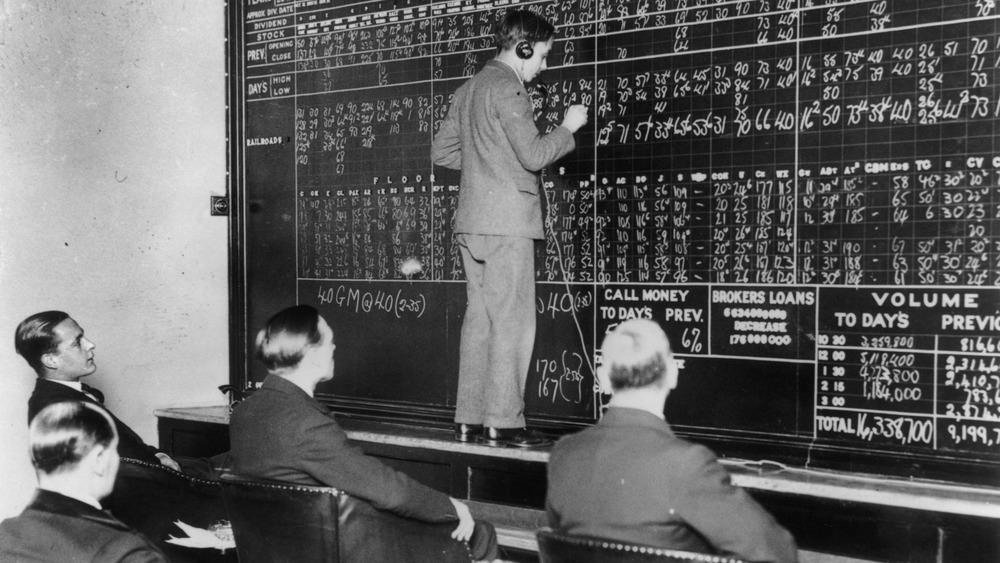

Trades happened so fast they could not be recorded in time

The relentless trading continued, and the ticker fell further and further behind. Time says that tickers could only produce 285 words a minute, so they could not keep up with the speed at which everyone was trading. This meant that traders and businessmen in Chicago, Los Angeles, and other major cities outside New York had to make decisions on hours-old information.

Since it looked like the market was on the verge of collapse, the selling continued because everyone wanted to get out while they still could. The selling was so intense that, according to Britannica, a record was reached of 12.9 million shares traded by the end of the day.

Stockbrokers across the U.S. were aware their information was horribly out of date but could do nothing about it. Any sense of optimism from the day before was completely gone as panic was now on everyone's minds. Even as early as 11:30 a.m., it was clear the market was taking a nosedive. It was not until much later at 7 p.m. that the ticker finally stopped recording, hours after the trades had officially ended.

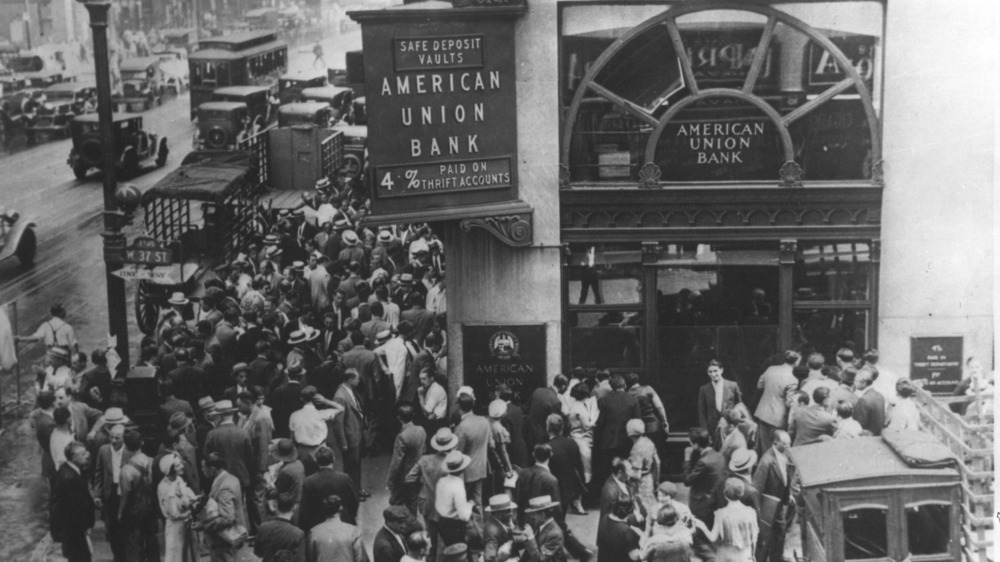

Crowds gathered outside the Stock Exchange

As fear and confusion gripped many throughout New York City, people began to gather and make their way to Wall Street in order to try to figure out what was going on. According to James K. Galbraith, Police Commissioner Grover Whalen was so concerned about the growing number of people in the streets that he sent officers to the financial district to make sure that no violence occurred. Outside the Stock Exchange, where most people had concentrated, an eerie roar was heard from all the frightened chatter of so many people.

In an old news clip featured by Weird History, the commentator described the scene with people stopping their cars at random places in the streets. Some of these people even climbed up on their car roofs so that they could see over the huge crowds. The police attempted to keep things under control by frequently using their whistles and shouting warnings, but the crowd dismissed them for the most part. Eventually, the police gave up and just joined everyone else to witness the terrifying event for themselves.

Furthermore, people from all over the country went to the offices of brokerage firms to try to get some answers as well. Yet, most would not get any clarity. To make matters worse, the visitors' gallery of the Stock Exchange was closed at 12:30 p.m. on Thursday, so outsiders could no longer see the mass trading, which only intensified the general uncertainty. Horrifying rumors then began to spread amongst the crowds instead, then spreading onward throughout the rest of the U.S.

Rumors of stockbrokers committing suicide spread like wildfire

Among the many rumors spread, James K. Galbraith mentions some of the most popular — like the exchanges in Buffalo and Chicago had shut down and that stocks had begun to sell for nothing. It was scary enough that many people seriously thought troops had to be deployed to New York City to keep the peace, though the most damaging and frightening rumors spoke of a suicide wave. These stories included at least 11 speculators who had already killed themselves that day.

The crowds on Wall Street believed the growing number of suicides so much that when a worker was seen on top of a building, everyone stared in anticipated horror to see him take the plunge. He did not, however, because he was just there to make repairs.

Fortunately, in retrospect, most of these rumors were false. There were certainly some instances of deaths related to the Stock Market Crash but nowhere near the numbers claimed in the rumors. For example, The Washington Post says there were only two suicides from men jumping off of buildings between Black Thursday and the end of the year. But the damage was already done, and the rumors contributed to the widespread fear and panic.

Wealthy businessmen tried to fix the stock market situation

Finally, help was on the way. Major heads of banks met at the offices of J. P. Morgan and Company around noon on October 24 and decided to invest heavily in the market. According to James K. Galbraith, the meeting included men with titles such as the chairman of the board of the National City Bank, the president of the Guaranty Trust Company, the chairman of the Chase National Bank, and the chairman of the Bankers Trust Company. Basically, the most powerful bankers in the country.

Thomas Lamont, the senior partner at J. P. Morgan, then addressed a group of reporters and let it be known that the bankers were going to solve the problem. In his book, Since Yesterday: The 1930's in America, Frederick Lewis Allen says that when the banker's representative, Richard Whitney, attempted to buy 10,000 shares of steel, only 200 were for sale. The selling spree halted. Like magic, these reassuring words and large investments worked temporarily as the market began to improve and prices increased. However, the attempts were ultimately made in vain, and everyone would soon discover that these masters of finance failed to make any sort of lasting impact.

Common people had to pay back their margin loans immediately

The influx of cash from the bankers briefly alleviated the issue but was not enough to stop the devastating chain reaction to the morning's mass trading. Many speculators had already lost faith in the market, so mass amounts of margin calls went out all at once. This means that tons of average people from all walks of life had to quickly pay back the loans they took out in order to invest in the first place. Most people simply did not have that kind of money on hand because much of whatever wealth they had was already invested in the market.

In order to pay their loans, people had to sell their houses, cars, and other valuables, or hand over the remainder of their life savings to have enough cash. Though in reality, it was impossible for that many people to sell their most prized possessions fast enough, but they still tried. According to The Washington Post, the Great Crash may have cost Americans as much as the grand total the government spent for its participation in World War I.

The worst occurs on Black Tuesday

The opening bell was not even heard the morning of Black Tuesday, October 29, because of all the frenzied shouting to try to sell stocks as fast as possible. The Financial Post says there were 3 million shares traded in just the first half hour, which is more than what would have been exchanged in an entire day only a few months previously. Once again, the ticker ran far behind. Everyone knew they were losing money, but nobody knew how much.

It did not take long before the phone lines were completely clogged, and there were so many slips of paper recording trades that the brokers just loaded them into empty garbage cans. Due to exhaustion, one trader passed out but then had to keep working once he woke up. The scene was so chaotic that fistfights even broke out on the trading floor.

According to History, the record of just a few days before on Black Thursday was broken after 16 million shares were traded during the notorious Tuesday. All in all, $25 billion was lost in the Great Stock Market Crash, which Time says would be like losing around $319 billion in 2008.

Wall Street closed down

After Black Tuesday, Wall Street first closed in order to clean up after all the mess and damage caused by the massive crowds that had gathered and the turmoil on the trading floor of the Stock Exchange. Then, at the beginning of November, Wall Street continued a "self-imposed" shut down for three days in an attempt to prevent any more damage to the stock market through massive selling.

When Wall Street reopened on November 4, trading was only allowed for three hours a day, which was another attempt to curb the amount of future damage. However, the shut down and limited hours only built up demand, so the disastrous selling continued whenever possible. Every day the Stock Exchange was open, it was overwhelmed for those three hours until November 13, when the market finally bottomed out. Weird History says that at this point, the market had decreased to less than half what it was worth two months before in September.

Stock markets crashed worldwide

The Great Crash reverberated throughout the world with devastating consequences. Europe was particularly affected since it had been the main theater of World War I, meaning that many countries were already in deep recessions due to war debt even before the Great Depression. As similar crashes occurred all over the world, there were few who came out of the disaster unscathed.

According to the World Trade Organization, global trade plummeted by 65% over the next five years following the crash. With the U.S., Britain, or any other country unwilling, or unable, to take the lead, there was no way to stabilize the various economies and markets worldwide. Furthermore, most countries did not want to cooperate because they had just fought against each other during World War I. The result of these issues was a rise of extremism and another world war, a terrible period for humanity.

People stopped spending money

A few months after Black Tuesday, wages fell even further, and unemployment continued to rise dramatically as mass amounts of people were laid off and unable to find work throughout the country. Those who did have money did not spend it out of fear, so anyone who somehow had the ability to save money just hoarded it as long as possible. This volatile combination in a recession led to the Great Depression.

History says that by 1932, stocks were so diminished to only be worth 20% of their value in the summer of 1929. At the lowest point in the economy a year later, unemployment was nearly 30%, and almost half of the banks in the entire country had failed. According to Time, the depression finally came to an end during World War II in the early 1940s. However, the damage of the Great Crash was so severe that the market did not fully recover all the way up until 1954.