The Wildest Inheritance Disputes Ever

They say money can't buy happiness, but they are clearly wrong. Money can make you very happy if you use it in the right ways. While some people get rich through their successful careers, winning the lottery, or marrying someone who is already rolling in it, others might spend much of their life in close proximity to great wealth – just waiting to get their hands on it.

For those whose parents or grandparents were the ones who built up generational wealth, it often doesn't get passed on until their relative dies. Ideally, the thankful heirs would be so happy they would take what their relative left them no matter how large or small a percentage of the pot, and go on to live happy, fulfilling lives. In reality, heirs to some of the biggest fortunes in the world tend to get a bit litigious as soon as the patriarch or matriarch who had been holding the purse strings dies.

While money can definitely pay for items and experiences that will make someone happy and can ease so many of the regular life stresses normal people face, for many rich heirs, it can also lead to the destruction of family relationships and decades of court costs. Yes, decades. In some cases, much longer. And that doesn't even guarantee that at the end they will come away with any more money than they were originally left. These are the wildest inheritance disputes ever.

Sir Jacob Downing

The world-famous University of Cambridge in England is a large school that is divided up into 31 different colleges. While their degree is ultimately from Cambridge itself, students also apply to a college they think will fit their lifestyle, since that is where they will sleep, eat, and make friends.

All this leads up to the fact that lots of important and wealthy people over the centuries would give money to the University of Cambridge to "endow" a new college – usually named after them. Gonville & Caius College, for example, was founded by two guys named Edmund Gonville and John Caius. When Sir George Downing died in 1717, he left a will instructing that if his family died off for lack of heirs, his fortune should go to founding a college, as the Downing College website explains. Since said college clearly exists, everything must have gone smoothly, right?

Wrong. The last living heir of Sir George was Sir Jacob Downing, who had no children. He had inherited a mess and, through a lot of hard work, turned it into something worth a lot more money. He didn't plan on giving it away to some school, so he left it all to his wife. When Sir Jacob died in 1764, Cambridge went to court to challenge the will ... for the next 36 years. Once the school finally won the case in 1800, they realized a lot of the bequest had been spent on lawyers and there wasn't really enough to build a new college anymore. But the university pressed on, slowly, and finally, in 1820, the first students arrived at Downing College.

J. Howard Marshall II

As Forbes explains, in 1991, Anna Nicole Smith, who was already well-known as a model, met the billionaire J. Howard Marshall II at a gentlemen's club. Three years later, the 26-year-old married the 89-year-old. One year after that, he died.

While that would seem to be ideal for a young woman with an old, rich husband, Howard hadn't actually put Smith in his will yet. That meant she and Howard's youngest son — also named Howard, and who was left nothing in the will as well – took the older son, Pierce, to court. The twists and turns were ridiculous and made headlines around the world. ABC News reported that Pierce claimed no fewer than 13 legal documents proved he was the heir, and that Smith was only with his father for the money. Smith claimed her husband promised to leave her half of everything.

The case saw contradictory decisions in a Texas state court and a California bankruptcy court. Eventually, the Supreme Court had to step in – but not to decide who got the money, just that Smith could keep fighting for the inheritance. But then, in quick succession, both Pierce and Smith died. Still, the case went on, since Smith's daughter could now theoretically be the heir to the large fortune. In 2015, Forbes reported that a decision had finally ended the legal fight ... except it hadn't because it was still going on in 2017, when the judge who'd been hearing the case from the beginning literally begged to be recused from any further litigation.

Sir Harinder Singh Brar

While the Indian subcontinent was home to dozens of royal families, since India won independence from Britain in 1948, they don't rule over parts of the country like they used to. However, many of these ancient families are still worth a whole lot of money.

According to The Indian Express, Sir Harinder Singh Brar was the head of one of those families, specifically the old rulers of the Faridkot state. He made multiple wills over the course of his life, with significant changes as he disinherited one of his three daughters for marrying a man he didn't like, then slowly reconciling with her before he died. That daughter, Amrit Kaur, was aware of these changes and the fact that she had been re-added to her father's will – so it was a shock when a totally different will was read out after she died, and she got nothing.

It would take 31 years of fighting in court, starting in 1991, with her two sisters, her uncle, and her cousin before the Indian Supreme Court finally settled the matter in 2022, BBC News reported. It upheld a lower court's findings that the final will was in fact fake. "The king was a learned man and had a beautiful handwriting. But that didn't reflect in his purported will which had so many mistakes in spellings, and his signatures had been forged," a forensic expert explained. But Kaur wasn't satisfied, filing suit against 23 people she said were part of the forgery plot, per India's The Tribune.

Teddy and Nina Wang

Nina Wang was at one point the richest woman in Asia, according to The Guardian, but that might be the least interesting thing about her. Nicknamed "Little Sweetie" by the public, she always wore her hair in pigtails even into her 60s, as well as a uniform of miniskirts and ankle socks. And despite all her wealth, she lived extremely frugally, even by non-billionaire standards.

Then there was the saga of her husband, Teddy Wang. The South China Morning Post reports that the wealthy businessman was kidnapped in 1990 and never seen again. However, this was actually the second time he'd been abducted; the first took place in 1983. On that occasion, he'd been released once a $33 million ransom was paid, but the second time, the $30 million Nina turned over wasn't enough to get him back. Nina and Teddy's father wound up in court fighting over his fortune, with three different wills produced. The case saw Nina jailed for forgery before finally winning her battle and inheriting her husband's whole estate.

When Nina died in 2006, her married younger lover, Tony Chan (pictured), always described in the press as a "Feng Shui master" produced a will which left him her $4 billion fortune. After a long court battle, which saw crowds of people fight to get seats to hear the strange details that emerged about their relationship, including their communications with the dead, it was ruled Nina had really left her money to charity. In 2012, Chan was sentenced to 12 years for forging the will, per BBC News.

Peter Thellusson

When an inheritance fight goes so badly wrong that the law is changed to make sure it never happens again, you know it was something extraordinary. Peter Thellusson was an English merchant who did very well for himself and his estate was worth a huge amount of money when he died. But rather than leave it to his family, or charity, or anything normal like that, he had instead written up what Lord Lyndhurst called in the U.K. Parliament "a will founded upon selfish vanity."

Through this will, Thellusson hoped to control his fortune long after he died. He instructed that his estate should essentially be held in a trust, and that all the interest on the estate be added to the total in that trust. The idea was that the pile of money would grow and grow. According to the United Kingdom Encyclopedia of Law, Thellusson didn't want this to be a short-term thing: he instructed it keep going until at least every one of his great-grandchildren – most of whom weren't even alive yet when he died in 1797 – were dead. At this point, any legal and probably pretty shocked heirs were to split the fortune.

This left Thellusson's family in dire straits, especially when the court upheld the will in 1798, per the Encyclopedia Britannica. By 1856, apparently all the necessary people were deceased, and a three-year court battle began over who should inherit the money. Thellusson's grand plan failed, since court fees and taxes meant hardly any more money had accumulated in almost 60 years, and lawmakers made sure the "Thellusson act" meant no one could ever pull that kind of stunt again.

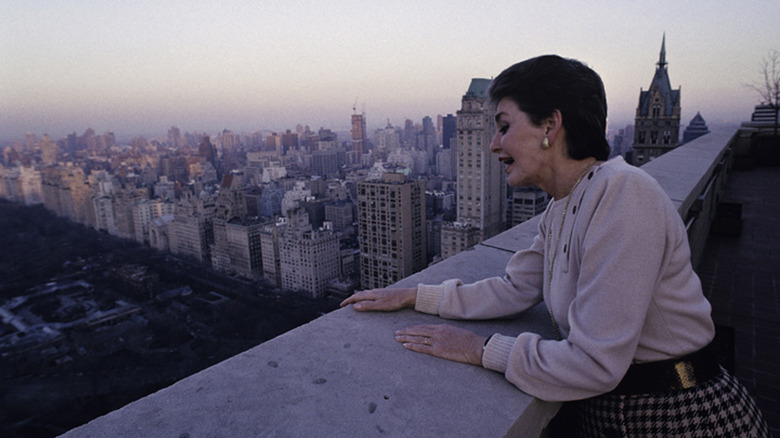

Leona Helmsley

Infamously known as "The Queen of Mean," Leona Helmsley was a self-made businesswoman long before she finally married at age 52, to a man even richer than her. She became famous for being terrible to people and very cheap, so much so that she was charged with tax evasion in 1988, according to The New Yorker. One witness at the trial claimed she'd heard Helmsley say, "We don't pay taxes. Only the little people pay taxes." She ended up serving time in prison after she was convicted.

After her husband died in 1997, Helmsley got an adorable dog named Trouble to keep her company. And it was the money she left to this dog that would make sure Helmsley was infamous long after her own death in 2007. Reuters reported that she left Trouble $12 million in her will. In comparison, she left her brother, who was instructed to be Trouble's caretaker, $10 million. And two of her grandchildren received $5 million each. What is often missing from this story, though, is that fact her estate was worth an estimated $4 billion to $8 billion – the balance of which was put into a charitable trust. So $12 million for her dog was a drop in the bucket.

Two of her grandchildren had been disinherited, as the will stated, "for reasons which are known to them," and they sued. In the end, they got $3 million each, while Trouble received $2 million, per Hackard Law. Further lawsuits included the will's executors suing to receive $100 million for their services, and three animal welfare groups suing for a larger part of the charitable trust.

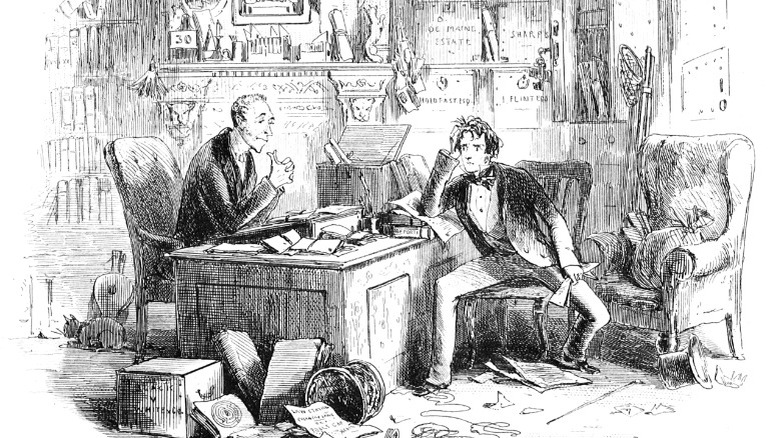

William Jennens

When it comes to fights over an inheritance, there's all the other crazy ones, and then there's the case of the Englishman William Jennens. To say Jennens was rich is an understatement; when he died in 1798, the Norwich Post reported (via The Foxearth and District Local History Society) that "He was reputed to be the richest commoner in England, his property exceeding two million pounds sterling." Unfortunately, the publication also noted that it was believed he died without making a will, and since he never married or had children, who should get the money wasn't immediately clear.

Enter ... well, dozens of hopeful, if tenuous, heirs. According to "Stranger Than Fiction? The Jennens Inheritance in Fact and Fiction Part Two: The Business of Fortune Hunting," people from all over England and indeed the world heard about the inheritance up for grabs and started trying to figure out how they might be related to William Jennens. It didn't help that, as the 1879 book "The Great Jennens Case: Being an Epitome of the History of the Jennens Family" explains, Jennens himself was a bit of an enigma and "doubts have been entertained as to his parentage." This meant the inheritance fight was a free-for-all. The resulting court cases dragged on for – wait for it – over a century.

It was such a spectacle that it's believed to be the inspiration behind the central court case in Charles Dickens' novel "Bleak House" (pictured). And, as in the book, by the time the fight was over, lawyers had taken the bulk of the fortune.

Fred Koch

Fred Koch (pronounced "coke") made his fortune in the oil business in the mid-20th century. His four sons – Frederick, Bill, Charles, and David — all had different levels of involvement in the family business, according to Mother Jones, and some fierce (and often violent) sibling rivalries. So despite the fact that Fred once instructed his sons to "be kind and generous to one another" (via CNN Money), when their patriarch died, they ignored him.

The inheritance left by their father in 1967 was, essentially, the family firm, Koch Industries. Technically, Frederick had been cut out of his father's will, but still owned a portion of the company through a trust. Now worth over $100 billion, Koch Industries was a huge conglomerate even back then. So the boys started fighting to control it, sometimes literally, like in 1980, when business disagreements led to what The New York Times described as "a boardroom brawl." Three years later, Charles and David bought Bill and Frederick out of the company completely for $700 million. A tidy sum, to be sure, but after thinking it over, Bill and Frederick decided it wasn't fair compensation.

The brothers spent the next 18 years in court, and the two factions did not speak to each other, even at their mother's 1991 funeral service. Their mother, in fact, had cut Bill and Frederick out of her own will, according to The New York Times. Accusations flew, including that Charles had tried to blackmail Frederick. The fight ended in 1998, with Bill and Frederick losing their claim to more money.

Samarjitsinh Gaekwad

No matter how much money is on the line, after more than two decades, even the most heart-hearted and money-hungry person might be sick of dealing with lawyers and court dates all the time. That was how the 23 members of the Gaekwad royal family of India felt, according to what one of them told The Economic Times in 2016.

Pratapsinh Gaekwad explained the family's epic 23-year court battle over the estate of the last Maharaja of Baroda "had gone for too long. And, we just saw it as a negative thing that was stopping everyone from doing anything positive. Every day, it was just about fighting a case. So we took a conscious decision to end it at pretty much any cost. Once we had that in mind, we worked hard towards it. Compromises had to be made for it to happen and we did that."

It wasn't just money that made the almost quarter century fight seem worth it for so long, though. The estate also included hundreds of acres of land, multiple palaces, and at least one successful business, according to Business Standard. Samarjitsinh Gaekwad got a particularly large chunk of the estate, including three diamonds that are so priceless and important they all have names, per Mint: the Star of the South, Akbar Shah, and the Empress Eugenie.

John Seward Johnson I

John Seward Johnson I, of the Johnson & Johnson company fame, was seemingly happily married to his wife Essie for over three decades – until he set eyes on a new employee in one of his homes, the 30-year-old Polish immigrant Basia Piasecka (pictured), per "Undue Influence: The Epic Battle for the Johnson and Johnson Fortune." And Seward was not content to make Basia his mistress: He divorced Essie and married Basia. Despite this scandalous beginning and the more than 40-year age difference, the couple were together until Seward's death 12 years later, in 1983.

After Seward died, his six children discovered he'd left almost all of his $500 estate to Basia, The New York Times reported. They took their stepmother to court, and were joined by the non-profit Harbor Branch Foundation, which also believed it was entitled to a cut of the late Seward's fortune, according to UPI. The Johnson children claimed that by the end their father was not all there mentally, and that the only reason he left everything to Basia was because she took advantage of his age and mental state, to the point of "terrorizing" him. Basia, on the other hand, claimed the marriage was happy and her stepchildren didn't care about anything but getting their hands on the money.

In the end, the case went to trial in 1986, with Basia saying she would never settle. However, right before the 4-month trial went to the jury, she changed her mind, and walked away with over $300 million, dividing the rest between the children and the charity.

Jay Pritzker

Jay Pritzker's fortune came from hundreds of businesses, most notably Hyatt hotels, according to Vanity Fair. Despite the truly unbelievable amount of wealth her left behind when he died in 2001, the Pritzker family had always chosen to avoid the spotlight. That is, until a 19-year-old member of the family, Liesel Pritzker, took her own father as well as various cousins to court over her inheritance in 2003, claiming they had stolen $1 billion from the trust fund for her and her brother and kept the siblings out of a secret agreement to sell off the family's companies.

The fight divided the relatives, put their dirty laundry on the front pages of newspapers, and generally was quite unpleasant, according to what Anthony and Jay Robert Pritzker told The Washington Post a decade later, after things had finally calmed down for their family.

The Chicago Tribune reported that it took two years for the family to settle the suit, and even then, not everyone was happy with the results. Liesel and her brother did walk away with $560 million, however, per The Houston Chronicle.