Musicians Who Were Charged With Tax Evasion

Just as Benjamin Franklin famously said (via National Constitution Center), "In this world, nothing is certain except death and taxes." This also goes for famous musicians as well. Yet for various reasons, after many artists have reached celebrity status, they have been charged with not paying what the law requires. For some, failing to file taxes is a form of protest against the government, while others are dealing with such complicated finances that mistakes are made, or trust is placed on the wrong people. That said, there will always be cases where celebrities are simply cheating the system.

On the other hand, there are certainly instances when musicians accused of tax evasion are completely innocent. Sometimes tax authorities attempt to find loopholes only to increase their coffers, so artists also have to stay vigilant as well to make sure they are not taken advantage of, especially when they have international careers that lead them to live in several countries throughout the year. There are too many artists that have had issues with taxes to list them all here, but below are some interesting cases both throughout history and much more recently.

Ja Rule

Back in the early 2000s, Jeffrey Atkins, aka Ja Rule, was a rising star in the rap world who had reached the level of fame to successfully cross over into film appearances in hits like "The Fast and the Furious" and "Scary Movie 3." However, the artist's fame had subsided quite a bit by the following decade, which might have something to do with the serious tax issues he began to face at that time and has continued to deal with up until very recently.

In 2011, Ja Rule pled guilty on three counts of not filing a tax return from 2004 to 2008. Not only would he have to pay the government over $1.1 million, but the artist could have also been handed prison time for up to a year on each count, according to Billboard. The maximum sentence would have been particularly rough because he was already facing two years in prison for the illegal possession of a firearm in 2007. Fortunately, the rapper was able to serve out both sentences concurrently and only remained locked up for a few months after the first term ended, says the Los Angeles Times.

In 2021, Ja Rule's tax issues continued as both he and his wife, Aisha Atkins, were sued by the IRS. In court documents obtained by Radar, the rapper outright refused to pay the $3.1 million he allegedly owes the government, so the agency demanded that the court enter a judgment. In response, he lawyered up with his established counsel, Stacy Richman.

Fat Joe

Fat Joe, whose real name is Joseph Cartagena, is another artist who began making rap hits, but also managed to successfully branch out into pop music as his fame increased. AllMusic says that throughout the 1990s and 2000s, the rapper ranked impressively on the Billboard charts and was nominated for Grammy Awards on more than one occasion. Yet, the artist's rise to stardom came with a price, one of which the U.S. government felt he had not paid in full.

In 2013, Fat Joe was sentenced to serve four months in prison for unfiled tax returns from 2007 to 2010. In that time, the musician earned an impressive $3.3 million, but did not pay any taxes on that income, according to the press release of the DOJ. On top of the prison sentence, he was also fined $15,000 and put under one year of supervision once released from custody.

Lauryn Hill

A decade after Lauryn Hill left The Fugees to release the Grammy-winning masterpiece, "The Miseducation of Lauryn Hill," as a solo artist, the singer left public life to focus on being a mother to her children. However, she ran into trouble with the authorities when it was determined that she had not properly paid taxes for the wealth she accumulated in the years following her massive success, a perspective which she very much disagreed with.

In a post on Tumblr, Hill explained that the issues arose because she was desperate to get away from unnamed individuals who had both manipulated her and treated her very poorly. She said, "It was critically important that I find a suitable pathway within which to exist, without being distorted or economically strong-armed. Failure to create a non-toxic, non-exploitative environment was not an option." She then made sure to stress that her taxes were covered in full up to this point, and she only stopped paying them "when it was necessary to withdraw from society, in order to guarantee the safety and well-being of myself and my family" (via ABC News).

Hill's explanation was not enough to avoid the charges against her, and in 2013, she was handed a three-month prison sentence for not paying taxes on $1.8 million worth of income gained from 2005-2007, as reported by the BBC. Following the initial penalty was a year of parole supervision for the musician.

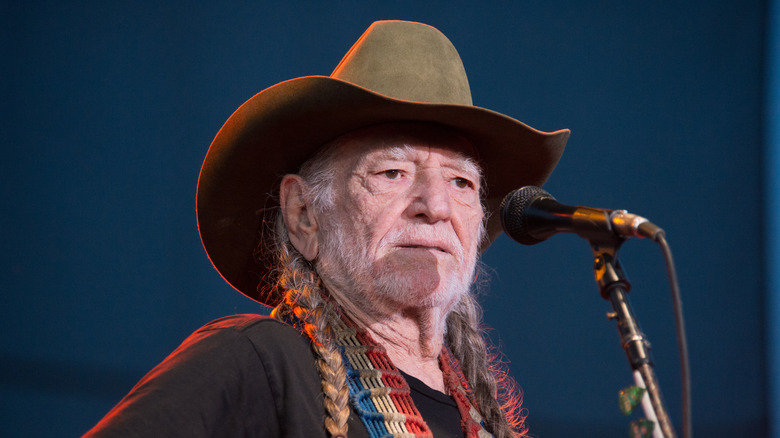

Willie Nelson

In 1991, Willie Nelson released a somewhat controversial, yet hilarious album called "The I.R.S. Tapes: Who'll Buy My Memories?" to help him pay an enormous bill in back taxes. Initially, the artist owed $32 million, but that total was later decreased to $16 million, which is still quite substantial. Even though the plan may seem a bit outlandish, the musician disagreed.

In an interview with the New York Times, Nelson said, "I thought they'd be crazy not to take it. The very fact they see a way to make a lot of money real quick made them go for it. They're not interested in sitting around waiting 10 or 20 years for the money to trickle in." Valerie Thornton, an I.R.S. spokesperson, voiced agreement with that perspective when she said, "We try to work with taxpayers, not just Mr. Nelson. And if we have to come up with some creative payment plan, that's what we're going to do, because it's in everyone's best interest."

The plan was a success as Nelson managed to earn $3.6 million in sales from the album, which helped considerably in paying what he owed. Yet ultimately, the real hero for the musician was his lawyer, Jay Goldberg, who did so well at the negotiating table that he managed to lower the total Nelson owed even further down to $6 million, as per Forbes.

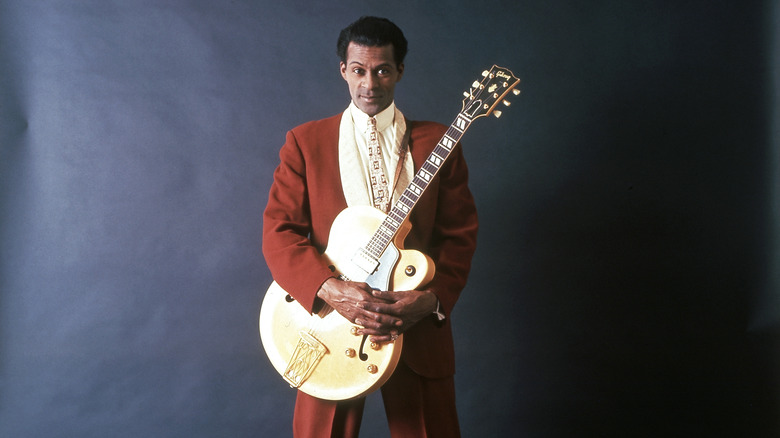

Chuck Berry

Chuck Berry is one of the greatest artists of all time, and he was revolutionary as the musical architect who formed the basis of rock & roll. According to AllMusic, the OG rockstar created a fusion of juke joint R&B with blues and hillbilly boogie to create a truly original sound, most notably with several huge hits like "Maybellene," "Johnny B. Goode," "Roll Over Beethoven," and "Sweet Little Sixteen." Yet, these great achievements did not stop the IRS from coming after him in the years following his success. In 1979, the rockstar pled guilty to tax evasion to the tune of $110,000 that he owed on income earned in 1973, reported the New York Times.

Berry then served a four-month sentence at the minimum-security prison located in Lompoc, California. Interestingly, Jet pointed out that two convicts of the Watergate scandal, H.R. Haldeman and John Dean, were locked in there as well.

Toni Braxton

Singer Toni Braxton has had massive success during her career with several albums that have gone platinum. She has also won numerous Grammy Awards and nominations and is just one of a few who has received the honor in each decade across 30 years, says AllMusic. On the other hand, the artist has continued to struggle financially as well regardless of her many hits. Both in 1996 and 2010, she was forced to file for bankruptcy due to excessive debt, which included unpaid taxes, according to the Wall Street Journal. Fortunately, most of what she owed was wiped away in 2011, but her troubles did not end there.

In 2018, Braxton had two tax liens filed against her, totaling to over $450,000 from the previous year, according to court documents obtained by The Blast. The IRS, along with the State of California, also demanded that she pay what was owed as quickly as possible or else they would resort to seizing her valuables to cover the cost.

Marc Anthony

Many musicians and celebrities get so big that they can just focus on their careers and then hire experts to deal with the mundane — though very important — aspects of their finances. This was the case for singer-songwriter Marc Anthony, who is one of the greatest salsa artists of all time. He mistakenly trusted his accountant to file his tax returns for him, but the supposed professional did such a poor job that taxes were not paid on $15.5 million worth of income in the years leading up to Anthony's marriage with actress Jennifer Lopez from 2001 to 2004, as per Reuters.

Once the massive discrepancy was detected, neither Lopez or even Anthony were charged with any wrongdoing because the blame was put almost entirely on both his accountant and manager, who were charged with tax crimes. The salsa star did enter a plea deal though, which required him to pay the $2.5 million he owed.

A few years later, Anthony made similar major errors again. RadarOnline.com discovered documents from 2010 with demands from New York authorities for the singer to pay back taxes of almost $3.5 million.

Method Man

For some musicians, their celebrity status has reached such a level that their income makes it difficult to keep track of everything, especially including what is owed to Uncle Sam. Then, after recreational drugs are thrown into the mix, the task becomes even more complicated. This was the case for rapper Method Man when the tax men came to seize his SUV to cover over $50,000 in debt. At least he was honest about the cause of the mistake when he said it happened "because I got high, I forgot to pay. It was stupid" (via The Guardian).

Although he never admitted as much, a similar situation may have arisen when Method Man, whose given name is Clifford Smith, was charged with tax evasion in 2010 for failing to make his full payments to the state and federal government from 2004 to 2007. Fortunately, the error was minor for the artist, so he quickly paid the total of around $100,000 without the incident making it on his permanent record, per The Hollywood Reporter.

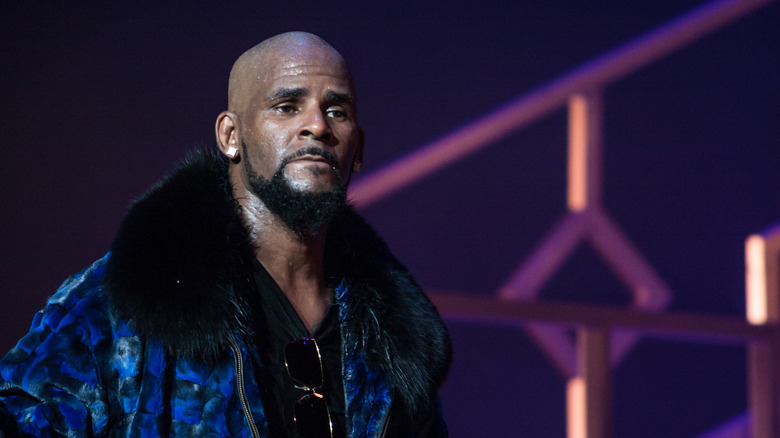

R. Kelly

R. Kelly, or Robert Kelly, has been in the news frequently for all the wrong reasons, so much so that his troubles with the I.R.S. are overlooked as they are relatively minor offenses in comparison. In 2012, it was reported by the Chicago Sun-Times that the R&B singer still owed $5 million in back taxes even after paying $2.6 million in 2008 and then another $1 million in 2011 (via The Guardian). This large debt existed even though a spokesperson claimed the artist had no financial difficulties at the time.

By 2021, Kelly was in jail for a very different reason and still owed the government nearly $4 million in total from income he earned over a decade before in 2008, as well as 2013 and 2016, according to court documents obtained by RadarOnline.com. After filing two liens against the singer, the I.R.S. threatened to seize his property until the debt was paid.

Luciano Pavarotti

In 2000, one of the greatest opera singers of all time, Luciano Pavarotti, agreed to pay $12.5 million in back taxes to the Italian government. But at the same time, the renowned performer did not agree with the charges leveled against him. He told the Italian newspaper La Stampa, "I wish to emphasize that I am innocent. I have always paid my taxes wherever I have sung but the Italian state believes I have not paid enough. I do not want to be known as a tax evader." Pavarotti then added a logical reason why there could be some confusion and said, "It's very difficult to explain the life of one who travels the world and who every year visits 50 different cities" (via MTV News).

Yet, the singer remained somewhat lighthearted over the controversy and was able to joke with Italian media outlet Mak-Multimedia Adnkronos, as he said, "I feel light — in the mind and also in the pocketbook." The defiance and optimism paid off, for it was only the next year when Pavarotti was completely cleared of his charges, per the Independent. The musician was fortunate as a conviction could have meant three years behind bars.

Nina Simone

Acclaimed jazz singer and pianist Nina Simone had one of the most prolific careers for a musician with around 60 albums created and over 500 composed songs. Despite her incredible talent, the artist endured rather difficult hardship, much of which stemmed from the fallout caused by unpaid taxes. In the late 1970s, the situation got so bad that she lost her home due to thousands she owed the I.R.S., according to ThoughtCo.

To deal with the problem, Simone simply chose to leave the U.S. and seek refuge first in Barbados, and then Liberia for a time. The decision came easy because the singer was fed up with the way she was treated by the record studios and she could not stand the racism that was rampant throughout the country.

But in 1978, Simone was convinced to return back home and appear in court over her tax evasion charges. Her lawyers were then able to work out a deal in which she pled guilty for not filing her tax return in 1972, but all the other charges were dropped, says Alan Light in his book, "What Happened, Miss Simone?" It was possible that she could have spent a year locked up, but she instead was only put on probation for 90 days.

DMX

Earl Simmons, often known by the stage name DMX, is another artist who, at the height of his career, was able to crossover into film, enjoying the massive success of hits like "Where the Hood At" and "X Gon' Give it to Ya." Yet, the rapper's skyrocket to fame was a complicated adjustment for someone who had previously only known struggle all his life. Thus, mistakes were made as DMX did not pay the required amount of taxes from 2000 to 2005, adding up to a total of $1.7 million due to the IRS, according to Reuters.

In 2018, DMX was sentenced to one year in prison after pleading guilty to one count of tax fraud. The punishment could have been much worse though at five years, but Judge Jed Rakoff felt empathy for the man and could see that he was a good person, so he doled out a considerably lighter sentence. The rapper also apologized for his actions in court, and a rare request was also approved for a portion of his popular song, "Slippin," to be played as well.

Phil Driscoll

In the 1970s, trumpeter Phil Driscoll firmly established himself in the pop genre, as he performed with several artists, including Leon Russell, Blood, Sweat & Tears, Joe Cocker, and Stephen Stills. However, the Grammy-winning musician transitioned into gospel the following decade and eventually founded a Christian music ministry in Tennessee. Driscoll was successful in the new phase of his career as well, which resulted in the recording of over 30 albums.

Then in 2006, the musician's career was turned upside down when he was not only convicted of tax evasion, but was also found guilty of conspiracy for the scheme he used to cheat the system with his Christian ministry. According to Today, Driscoll manipulated the accounts to avoid paying for $1 million worth of income from 1996 to 1999, getting away without paying $300,000 in taxes.

The year that the artist served in prison following his sentencing was deeply traumatic. Driscoll told Screen Daily, "You can't go through the devastation I went through without it being a life-changing experience. The time I spent in prison opened my eyes and gave me a perspective on life that I could not have found on my own. My time there was the most devastating time of my life. But looking around me, I saw men and families that were destroyed forever." Afterwards, the musician wrote and produced a film about his ordeal called "Long Day Journey."

Shakira

Colombian pop megastar Shakira Isabel Mebarak, often known simply as Shakira, is embroiled in one of the most extreme cases of alleged tax evasion by a musician in recent years. While Spanish officials claim she lived in the country over the limit of 183 days, the singer vehemently denies those accusations and that she owes the government €14.5 million in back taxes and penalties for income she earned from 2012 to 2014, says the New York Times.

In her mind, Shakira has been unjustly targeted as a source of wealth because there is no way she was in Spain for that long. During those years, the artist was on tour most of the time, and when she began dating Gerard Pique, she was out of the country for 240 days. Yet, she thinks that it was her relationship with the famous footballer that led them to come after her. The singer told Elle, "It is well known that the Spanish tax authorities do this often not only with celebrities like me (or [Cristiano] Ronaldo, Neymar, [Xabi] Alonso, and many more), it also happens unjustly to the regular taxpayer. It's just their style. But I'm confident that I have enough proof to support my case and that justice will prevail in my favor."

A trial has been approved by a judge near Barcelona, though the day in court has not yet been set. In the meantime, Shakira and her lawyers are building their case to prove her innocence, regardless of the severe consequence of eight years in prison that she could serve if found guilty.